By Deb Kemper and Kathryn Swintek, Managing Partners, Golden Seeds Funds

May 26, 2020

Editor’s note: As businesses grapple with massive change, two of the Managing Partners of our Funds – experienced investors and board members of both public and private companies – shared their advice on the new and expanded role that boards must play.

Anyone serving on a board today knows it’s anything but “business as usual” in a world transformed by the pandemic. Companies of all types and sizes must adapt to survive and function effectively. In this environment, the role of the board of directors has become even more critical as they’re called upon to help companies and CEOs deal with extreme challenges.

Many CEOs may find themselves struggling to manage unprecedented and stressful situations, and they need a sounding board to help them absorb news, assess needs and assign priorities — and it’s often up to board members to step in and help during this critical time. Board members often serve as trusted advisors and coaches who can brainstorm with CEOs about problems and solutions, enabling them to project an air of calm leadership.

This partnership is vital at a time when rapid change is the norm, feedback loops are accelerated and urgent decisions must be made quickly. Many boards are holding meetings much more frequently – and sometimes less formally – to review pressing matters such as financial forecasts, funding needs and succession planning for business continuity.

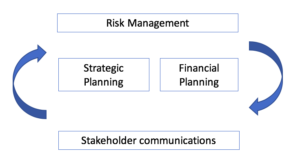

Here’s a look at how four essential board responsibilities have expanded or changed during the current crisis.

Risk management

Risk management is always important, but it’s become a top priority not only for a business but for its board. Members need to be alert to any new and increased risks and ensure that a company is addressing them adequately. Here are five key areas to consider.

It’s incumbent on the board to help CEOs constantly “scan the horizon” to monitor for these risks and to make sure they’re regularly addressed at meetings and in informal discussions. The next step is helping to develop a plan to mitigate these and other issues as much as possible.

Strategic planning

Planning is exponentially more difficult when dealing with a huge unknown: when and how the economy will re-open. Boards must acknowledge that uncertainty and help the CEO think through multiple scenarios — ranging from best case to worst — and appropriate responses.

This isn’t a one-and-done situation. Constantly changing conditions demand frequent updates, reviews of prior assumptions to see if they remain valid, and regular assessments of the impact on revenues and expenses.

It’s important to maintain an ongoing dialog between the board and the CEO and to keep it constructive. Boards can play an invaluable role in providing CEOs with more assistance, sharing some of their burdens and bolstering their position as a capable leader. A calm, confident CEO can better manage the anxieties of teams facing constant and rapid change.

Financial planning (fiduciary responsibility)

There are more unknowns than usual, so boards will have to be more involved than ever in assessing revenue and expenses and helping the CEO decide on appropriate expense levels.

Boards must be prepared to step in if a company is not meeting its revenue and cash goals, recommending any actions needed to prevent mounting debt. Adjustments might include cutting expenses, determining whether any commitments can be cancelled or deferred, and developing more realistic plans for revenue outlook.

It’s also necessary for the board to keep an eye on the risks outlined previously. This includes credit risks and problems with receivables if clients are delaying payment, as well as potential disruptions to the supply chain, so they don’t negatively impact revenue streams.

In normal times, budgets are typically reviewed quarterly and forecasts are updated as needed. But now, with the deluge of new, meaningful information coming daily, boards may be reviewing new forecasts monthly or even more frequently.

Fundraising strategy

It’s possible a company will need to raise capital to get through this difficult period, so helping develop a funding strategy is a critical part of the board’s role. Ensuring adequate liquidity might mean raising capital, and it may be necessary to consider new terms for doing so and/or financing structures. Board input and brainstorming on these matters can be very helpful.

Once the work on revenue outlook and expenses has been done and there is some clarity on the worst-case scenario for cash runway, the board can help the CEO plan a fundraising strategy. Points to evaluate include: amount of capital needed, what funds will be used for, how much time it will take to raise the capital, how long it will last and the capacity of existing investors. The board needs to assist in evaluating the terms of that round of fundraising, including an appropriate valuation to arrive at a price the market will accept.

In addition to raising capital, it’s important for the board to make sure the CEO is aware of other funding sources, such as government grants and SBA loans. The board can ensure the company applies for all applicable funding and explores government resources that can help.

Stakeholder communications

Now, more than ever, it’s critical for a company to communicate with all its stakeholders, adapting communications for each group in terms of frequency, content and tone. It’s become essential for boards to make sure this is done well. Boards can guide CEOs on best practices for communicating with employees, shareholders, clients, suppliers and the board itself.

Now, more than ever, it’s critical for a company to communicate with all its stakeholders, adapting communications for each group in terms of frequency, content and tone. It’s become essential for boards to make sure this is done well. Boards can guide CEOs on best practices for communicating with employees, shareholders, clients, suppliers and the board itself.

At a minimum, the board should have confidence the company has identified all stakeholders and has a plan for communicating appropriately with each. That includes determining the appropriate level of information shared, the right tone and the best timing. Given that the staff is one of the most important stakeholders for any business, the board will want to know how the company is managing its employees remotely and provide guidance as needed.

Times have changed, and the challenges are new and many. In response, boards need to rethink their evolving roles, take on new responsibilities and adapt to current conditions to ensure the survival and health of the companies they serve.