Loretta McCarthy, managing partner, Golden Seeds

August 30, 2018Implicit bias is when we have stereotypes or attitudes toward people without consciously realizing it. Therefore, by definition, implicit bias is a tricky thing to recognize and understand.

Among those who encounter implicit bias are women entrepreneurs looking for funding. A fact that Columbia Business School Doctoral Fellow Dana Kanze shared during a recent presentation to Golden Seeds investors tells the story: Women entrepreneurs often face a different line of questions than male entrepreneurs — leading to discrepancies in funding, support and ultimate success.

The entrepreneurs who apply to Golden Seeds, who are usually women, often feel this bias, both implicitly, and explicitly in feedback they receive from potential funding sources. Kanze says there is a way entrepreneurs and investors can attempt to break through this bias. She leverages the concept of promotion vs. prevention in research co-authored with colleagues at Harvard Business School (Laura Huang) and at Columbia University (Mark A. Conley and Tory Higgins) that was recently published in the Academy of Management Journal and Harvard Business Review.

Implicit bias leads investors to ask very different questions of entrepreneurs based on their gender. Some founders (men) tend to get promotion questions in the domain of gains, while others (women) are asked prevention questions in the domain of losses. What’s the difference?

Implicit bias leads investors to ask very different questions of entrepreneurs based on their gender.

Let’s look at two common questions by investors:“How long will it take you to break even?” versus, “How do you plan to monetize this idea?”

The first question is promotion-based, and focuses on potential gains with concepts like hopes, accomplishments, and advancement needs. An answer to this question might use words like “grow,” “expand” and “momentum.”

The second question is prevention-based. It focuses on potential losses, and concepts like safety, responsibility, and security needs. Answering this question might include terms like “careful,” “protect,” and “loss.”

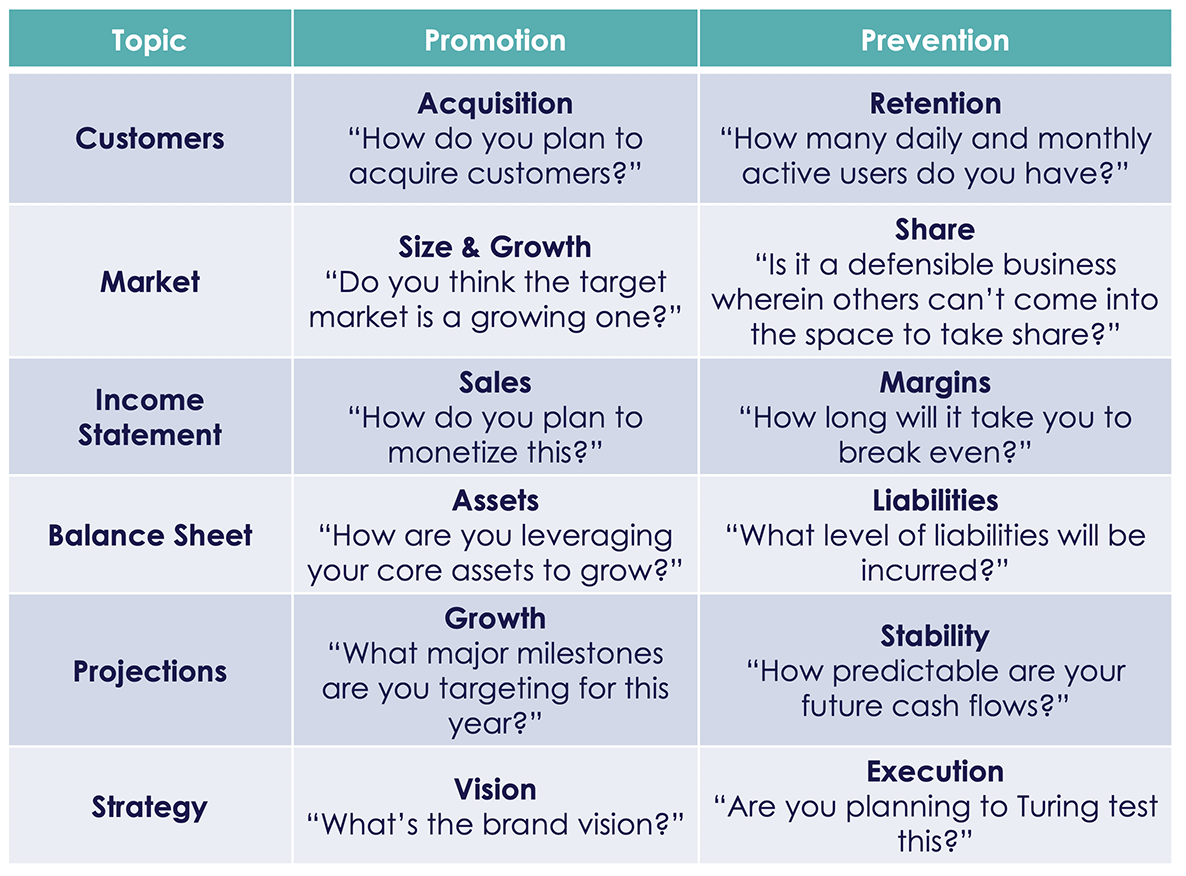

Below are examples from Kanze and her colleagues’ research of promotion versus prevention questions that further illustrate these biases:

Source: Dana Kanze, Columbia University

Source: Dana Kanze, Columbia University

Make no mistake, both promotion and prevention questions are part of a thorough meeting with any entrepreneur. However, female entrepreneurs tend to be asked more prevention questions, while male entrepreneurs get more promotion questions.

The effects of this shift in question focus are astonishing. Kanze and colleague’s research shows that entrepreneurs who are asked primarily promotion questions raise, on average, seven times more money than those who face mainly prevention questions.

Kanze and colleague’s research shows that entrepreneurs who are asked primarily promotion questions raise, on average, seven times more money than those who face mainly prevention questions.

The risks of this type of bias are clear for entrepreneurs in search of funding. But, on the investor side, the risks of this bias are also severe. By framing more prevention questions to women founders, they miss out on potentially lucrative investments and expose themselves to greater risk from companies that hear primarily promotion-oriented questions.

To prevent this bias from slipping into their meetings investors must recognize the types of questions they’re asking. It’s OK — and necessary — to ask prevention questions; they help identify risks. The key is to frame questions consistently, whether the entrepreneurs in the room are men or women.

For entrepreneurs, as part of improving your pitch, learn to recognize when you’re getting too many prevention questions, and switch your answers to promotional tone and content. If you’ve been facing prevention questions and someone asks, “How long will it take you to break even?” shift your response to a more promotional bent, like how you plan to monetize your idea.

This strategy’s effectiveness is shown in Kanze and colleague’s research, both in the field and experimentally. Those who answered prevention questions with promotion-focused responses were allocated significantly more investment funds.

By recognizing implicit bias — in this case in the form of the questions asked, and how they’re answered — and taking steps to correct them, investors can help put male and female founders on a more equal footing. And entrepreneurs will learn to adapt their responses so as to build the confidence of potential investors.

Kanze’s research has provided significant insight into these important issues. Read more about her research in Inc. and Forbes.

Learn more about Golden Seeds companies and how women entrepreneurs are achieving success with Golden Seeds.