A few weeks ago, I had the pleasure of speaking about financial empowerment to women leaders from around the world with economic and personal influence. This took place during the Journey to Legacy simulcast which launched ShoulderUp, co-founded by EY Entrepreneur of the Year, Phyllis Newhouse and Academy Award winner, Viola Davis. This dynamic movement is dedicated to connecting and supporting women on their journey to bring about change where and when it is needed the most.

It was inspirational to see so many powerful leaders come together in an effort to raise the influence and economic position of women. As I listened to Phyllis and Viola discuss their personal journeys and all the factors that made them who they are today, I was completely in awe. They told their stories in an honest and raw way to help all of us see that everyone has struggles. The live event provided numerous other examples of women recounting their experiences. Still, this was about more than inspirational stories; we all left with a greater understanding and determination to make a difference.

The following recaps some of what I covered, which hopefully gives you an idea of why Golden Seeds is stepping in to ShoulderUp — and why you should, too.

Women entrepreneurship is growing but there’s an investment gap

When we started Golden Seeds in 2005, our goal was to change the limiting corporate cultures we, as women, experienced on Wall Street. In short, we felt women needed to own businesses in order to help increase female leadership and parity.

At that time, women held 1.8 percent of CEO positions in public companies and 14.7 percent of board seats. Since then, these figures have climbed to 4.1 percent and 22 percent respectively. Women are now starting businesses at record levels — nearly 1,000 a day — driven by fresh perspectives, skills and talent proven to build great companies. These leaders are shaping businesses, producing beak-through innovations and creating jobs.

Our economy deserves to reap the benefits of what female-led companies can accomplish.

Today, 20 percent of angel investors are women — four times higher than when Golden Seeds started. About 24 percent of angel-funded companies are women-led, eight times greater than in 2004. This demonstrates that women investors will drive capital to other women.

Yet, while there’s success in the angel market, there’s a grim set of data on the venture capital (VC) side. That’s the logical place for acquiring the larger backing to take an idea to the next level and like all early-stage entrepreneurs, women need VC to fuel growth — but a major gap exists. Last year, women-founded companies received only two percent of this financing, resulting in much lower company valuations.

Yes, there are now conditions under which angel funding of women is expanding; Golden Seeds is proud to have had a role in this. But that vital venture funding is not yet moving to them. This is jeopardizing businesses that could have a tremendous impact on our economy and society, ones that might also offer the greatest investment opportunities of our lifetime.

It’s time to step in and ShoulderUp

Women are building amazing companies. As a global industry expert and leader of the largest private cybersecurity firm in the United States, ShoulderUp’s Phyllis Newhouse is a prime example of what can be achieved. She is a force.

Phyllis credits the women in her life, her family, the military, the EY program and the Women Presidents’ Organization for her personal development. It’s clear she understands the power of support and inspiration and has injected it into ShoulderUp. As a result, the initiative is rallying and connecting our community in ways that will help us all advance.

At Golden Seeds, we appreciate and back entrepreneurs that are making a difference. Susan Catalano of Cognition Therapeutics is developing a drug for Alzheimer’s. Christina Lampe-Onnerud of Cadenza Innovation introduced a revolutionary new paradigm for lithium ion batteries and renewable energy. Uzma and Rosina Samadani have created an important concussion diagnostic.

Golden Seeds has chosen to support the ShoulderUp movement because of its focus on the importance of creating economic parity for women — and we’ve witnessed the benefits firsthand. We invite you to step up and do the same for the sake of equality, advancement and real economic opportunity.

Learn more about Golden Seeds companies and how women entrepreneurs are achieving success with Golden Seeds.

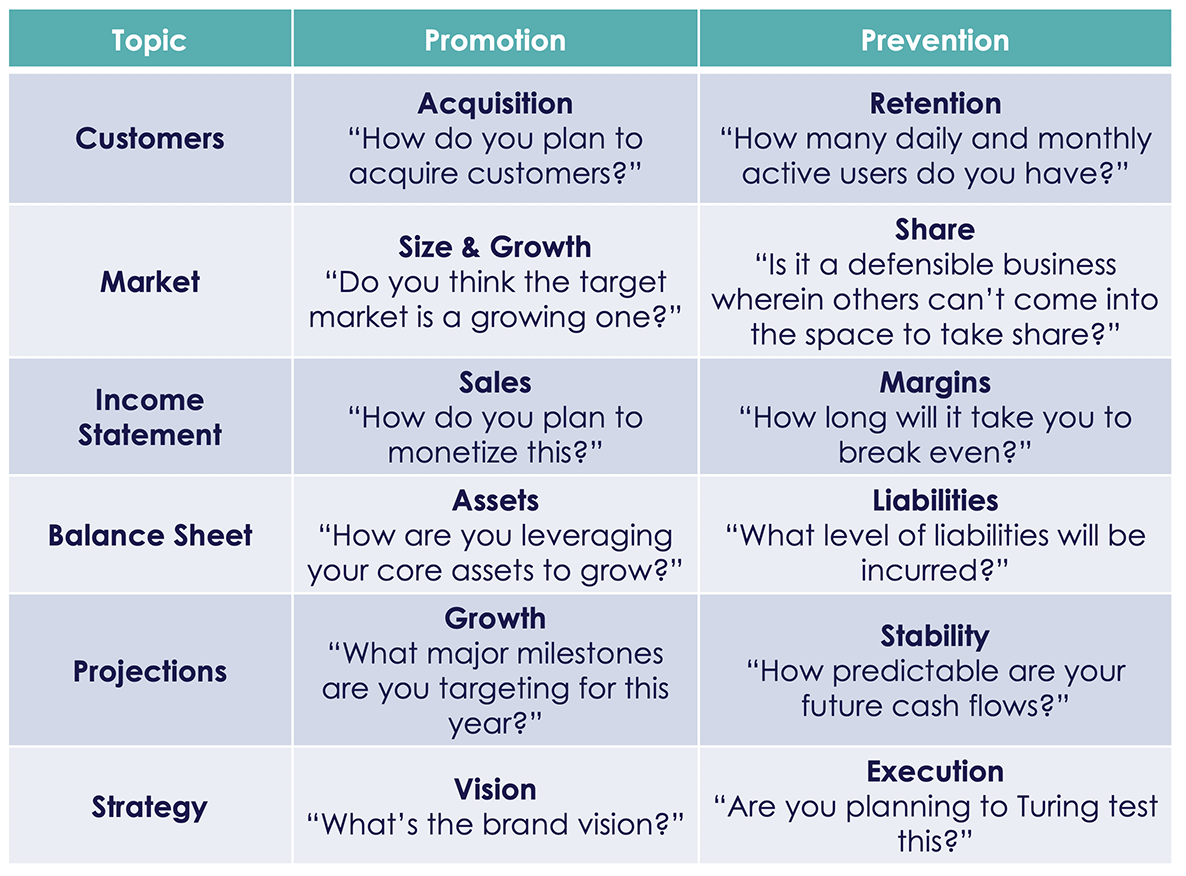

Source: Dana Kanze, Columbia University

Source: Dana Kanze, Columbia University

Golden Seeds is focused on investing in the vibrant opportunities of women-led companies. As such, we work with many talented, passionate female entrepreneurs who are doing truly remarkable things. Our “How Did She Do It?” series shares the stories, challenges and successes of the women behind the companies of Golden Seeds.

Golden Seeds is focused on investing in the vibrant opportunities of women-led companies. As such, we work with many talented, passionate female entrepreneurs who are doing truly remarkable things. Our “How Did She Do It?” series shares the stories, challenges and successes of the women behind the companies of Golden Seeds.

Sheryl Schultz, co-founder and COO of CabinetM

Sheryl Schultz, co-founder and COO of CabinetM