There’s an urgent need to stop COVID-19 from spreading and effective disinfection is the key. Studies have shown that improperly cleaned healthcare surfaces cause unnecessarily high rates of infections. To address that problem, Katherine Jin and two fellow Columbia University undergrads—Kevin Tyan and Jason Kang—founded a company called Kinnos during the 2014 Ebola epidemic.

Kinnos’s product, Highlight®, colorizes disinfectants so users can see when a surface is completely and properly cleaned, which can slash transmissions. Simply put, the company’s goal is to empower people to protect themselves and others through disinfection you can see.

Katherine recently shared her experiences and advice for other startups with Laura Davis, Managing Director of Golden Seeds, who led the due diligence team for Golden Seeds.

LD: Tell us about the origins of Kinnos.

KJ: In 2014, Jason, Kevin and I entered the Columbia Ebola Design Challenge hackathon to address the Ebola crisis in West Africa. Healthcare workers told us decontamination wasn’t being done correctly, and infections were rampant, especially among doctors, who accounted for one in 20 of those infected. Realizing there was a need for disinfection you can see, we came up with the idea to colorize disinfectants. The color shows when the entire surface has been covered and disinfected. It fades when the appropriate amount of time has passed (about 10 minutes in the case of Ebola).

We won a half-million-dollar grant from USAID, went to Africa and worked with NGOs. It was amazing and life-changing. We believed that this idea could improve lives around the world, not just during epidemics but in all healthcare settings where infections such as MRSA and C. diff are serious problems. That’s how Kinnos was born.

LD: What market need are you solving and how does your approach differ from others trying to address this need?

KJ: Our goal is to help people use disinfectants effectively to stop pathogens. Research has shown less than half of critical surfaces are properly cleaned, which contributes to hospital-acquired infections. Proper cleaning can reduce transmissions by up to 80%. Disinfectants are clear and tricky to use. You can’t see if the entire surface is wet, and if you don’t leave it on long enough, it won’t eliminate all the pathogens.

Our product, Highlight, is a patented additive color platform that comes in two forms: as a lid attachment to wipe canisters that colorizes bleach wipes as they pass through the lid and as a powder you add to liquid bleach solutions. It turns bleach blue, for example, and fades to colorless when decontamination is complete after a few minutes. It’s intuitive so it makes anyone a disinfection expert who can see when the surface is clean, regardless of language, education or training.

LD: What challenges have you encountered along the way? How have you overcome them?

KJ: As a young team, it was challenging to break into the notoriously difficult health care space. We had to put ourselves out there, which was hard for me personally; as an R&D scientist I preferred to hide in the lab. But by networking, keeping everything anchored to evidence and data, and evangelizing our product, we proved we were serious. We also gained gravitas by building an advisory board of key opinion leaders in our space, such as Bill Rutala, who helped write the CDC guidelines on hospital disinfection. The experts’ belief in us helped validate our legitimacy. We also did rigorous testing to prove Highlight didn’t reduce the potency of disinfectants or pose any risk to humans.

LD: What’s coming up next for your company? Any big milestones on the horizon?

KJ: In 2019, we soft-launched Highlight Wipes at several hospitals. We just closed a $6 million round of funding that Golden Seeds took part in, and our goal is to roll out a larger launch at hospitals in July. We’re hoping to play a more active part in reducing COVID-19 infections; some hospitals already use our powder product for that purpose.

We’ve also diverted some of our supply chain to make hand sanitizers, which we’re donating to hospitals and healthcare workers. Treatment is obviously critical, but so is prevention. At the end of the day, if you’re not cleaning properly, you won’t stop the epidemic.

LD: What advice do you have for early-stage founders about growing a team, fostering company culture or other issues you’ve had to address?

KJ: One of the coolest aspects of being a founder has been the opportunity to build a culture and team that reflect our values. If you can be proud of your company ethically, you’re more likely to succeed. Jason, Kevin and I are good friends who trust each other implicitly. We’ve built a culture that stresses respect and positivity, and discourages competitiveness and infighting. We’re all dedicated to pushing the research forward as a team.

In any startup, it’s critical for the founders to do what’s best for the company rather than their individual benefit. It’s also important to have a diverse team, with people from different backgrounds, genders and ethnicities. As a woman in a technical space, I’ve had to work extra hard to be taken seriously. Women entrepreneurs need to stand up for themselves. You have to be your own advocate, be proud of your work and project confidence.

LD: Tell us about your experience with Golden Seeds and its network.

KJ: Golden Seeds had been on my radar for a long time. When we first started raising our seed round in 2016, we tried to raise money from Golden Seeds. Although we didn’t achieve funding then, we received some great advice. For example, when I was pitching, one of the women investors pulled me aside afterward to say that I had a tendency to be self-deprecating, and that I could be more assertive and project more confidence. That kind of feedback and support from other women is invaluable.

Golden Seeds has also been really helpful in opening up their networks to us which has been incredible. It’s not easy to bring a new product into a hospital, but Golden Seeds helped legitimize us and made it easier to navigate the system.

Learn about Golden Seeds work.

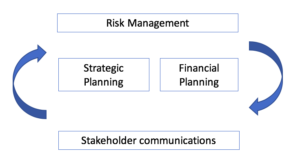

Now, more than ever, it’s critical for a company to communicate with all its stakeholders, adapting communications for each group in terms of frequency, content and tone. It’s become essential for boards to make sure this is done well. Boards can guide CEOs on best practices for communicating with employees, shareholders, clients, suppliers and the board itself.

Now, more than ever, it’s critical for a company to communicate with all its stakeholders, adapting communications for each group in terms of frequency, content and tone. It’s become essential for boards to make sure this is done well. Boards can guide CEOs on best practices for communicating with employees, shareholders, clients, suppliers and the board itself.