Social media can be a vital link to customers during the COVID-19 crisis — provided it’s used responsibly, Greg Dale, COO at Shareablee, stressed during a recent Golden Seeds Trend Talk. Greg explored the ways brands communicate on social media, sharing insights on which companies do it well and why. Since 2014, Golden Seeds has been an investor in Shareablee, a leading platform for measuring and managing social performance for brands and agencies. The Golden Seeds Trend Talk series focuses on topics that are relevant, instructive and inspiring, and Greg’s observations – summarized in this blog – certainly fit the bill.

Everything changed in March 2020

When COVID-19 erupted in March, business — like life in general — underwent an almost-overnight transformation. The normal ways of reaching customers suddenly went out the window. Companies pulled back from advertising, instead turning to social media, where consumers were flocking in unprecedented numbers. Our analysis of year-to-date activity and an online survey of 1,000-plus users in March showed a huge increase in traffic across all platforms, with more than two-thirds of respondents using social platforms more than they did before the pandemic hit.

At first, everyone wanted only news and updates on COVID. Social platforms emerged as a go-to source, second only to web searches for COVID news. There is still a strong desire to stay up-to-date, with some users checking Facebook, Twitter, Instagram, YouTube and other outlets up to 10 times a day.

But over time, we’ve seen a gradual shift toward different kinds of content—posts that put the facts in perspective, exploring what the “new normal” looks like and what’s coming next. Rather than a strict diet of news, consumers are hungering for a balance of serious information and messages that lighten the mood and put a smile on their face. Nearly half of people in the U.S., particularly males and younger consumers, want more funny content or a mix of facts and fun. They also want hopeful, optimistic messages that remind them of the good in the world and provide hope for tomorrow. They’re seeking, and sharing, positive posts that make them like the world we’re in a little bit more.

What kind of posts and strategies are companies using?

Companies are revamping their media strategies to satisfy these evolving preferences now that they’ve gotten over the initial panic and uncertainty about what will work in this new world. A look at a few key vertical markets demonstrates some of the new themes that have emerged.

Publishers are seeking to remain relevant by offering articles on home exercise, mental health support and tips on staying healthy at home. Influencers are trying to offset social isolation by bringing audiences together online for various events.

Retailers are stressing positive, hopeful messages with the theme of caring for one another during these difficult times. Grocery chains are setting up food donation boxes so nobody goes hungry. They’re also turning to humor, suggesting this is a good time to upgrade your linens since you’re probably spending more time in bed.

Manufacturers are taking a similar approach, highlighting the ways they are supporting those who need help — out-of-work restaurant workers or first responders, for example. They’re showing their good citizenship, switching gears to make hand sanitizer or face shields. Communications companies are doing their part, with telecommunications providers such as AT&T giving free service to healthcare workers.

Sports brands are humanizing this isolation, underscoring that we are all in this together — for example, showing how athletes, too, are now working out at home. They’re assuring fans they are missed, encouraging team spirit and reminding them that this won’t last forever.

Of course, not every execution is flawless. Companies must recognize missteps and be agile enough to recover from them. Victoria’s Secret, for example, got negative feedback to a post showing a woman dressed up for a night out, at a time when most of us were stuck at home. The company quickly pivoted, repositioning the ad with a more appropriate message: Dress up for an at-home night with your partner or even just for yourself.

While engagement on social platforms is up, new content generation is down. Businesses have quickly learned that they can successfully repurpose existing content for the current environment, remixing and reusing old material in new ways. NatGeo is using previous footage to highlight the fact that animals in the wild are benefiting from social distancing from humans, then goes on to educate viewers about those animals. In an interesting twist, some companies are finding that posts that didn’t work before do now because there are new, bigger audiences spending more time online. One caveat here: If a video or photo was shot previously and reflects conditions before the shutdown, it’s important to note that so it’s not seen as inappropriate.

Lessons learned from successful posts

The most successful of these social media campaigns have a number of things in common and offer useful takeaways:

- Authenticity is imperative. Talk directly to your audience.

- Lower production values are OK. The public knows professional crews can’t function now, and they’re willing to accept videos created with phones and tablets.

- The most successful videos are short and to the point. The key is more videos, not ones that are longer.

- Storytelling has a new focus. The emphasis is on taking care of yourself and your family, such as tips on cleaning house, teaching kids about germs and cooking restaurant-style recipes.

- Humor can lighten the burden of isolation. Consumers want content that makes life less stressful.

- Existing content can resonate with consumers today if it’s appropriately repackaged.

What you can do

Almost all categories of business could be doing more to communicate with, connect with and entertain their audiences right now. Here are four concrete steps you can take to enhance your own marketing efforts:

- Create social content that’s useful, informative and/or empathetic about the “new normal.”

- Offer your customers valuable distractions.

- Focus on key themes: What’s happening? What does it mean to me and others; how do I cope; can I find a way to laugh about parts of this? As citizens: how can I, and we, help; what’s next? At all costs, avoid any appearance of opportunism.

- Manage your community. Engaging with other brands on social media opens up a myriad of content opportunities.

How to measure success in a COVID environment

It’s important to track performance so you can refine your strategy as needed. But the metrics you’ve used in the past may not apply right now, so be prepared to redefine benchmarks. You won’t see the same numbers you did a few months ago, but that doesn’t mean a post isn’t successful. Category, platform and brand benchmarks should adapt to new measures of success.

In the near term, metrics that evaluate your brand perception will be critical. The key metric to focus on is how many users are engaging with your content by clicking, liking, sharing or commenting. Dial in on content that evokes pass-along value and dialogue, and pay attention to the social engagement types.

Stay on your toes. Analyze post performance in real time and optimize as much and as quickly as needed. Categorize your posts by themes and platform formats and be nimble enough to get rid of what’s not working or to tweak it to make it work.

Doing nothing and staying silent for fear of saying the wrong thing is not a strategy. If you go dark or leave business-as-usual content up there, then you are not trying. Although many brands initially hesitated for fear of a backlash to inappropriate messaging, those that dipped a toe in the water and adapted until they found the right themes and approaches are being rewarded.

Make sure you’re among them: Let customers know who you are, what your company is about and how you’re going to help them get through this crisis to the other side.

Learn more about Shareablee here.

Jill Johnson is the Co-Founder of the

Jill Johnson is the Co-Founder of the

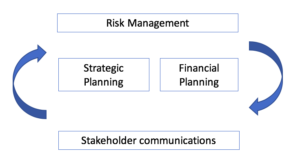

Now, more than ever, it’s critical for a company to communicate with all its stakeholders, adapting communications for each group in terms of frequency, content and tone. It’s become essential for boards to make sure this is done well. Boards can guide CEOs on best practices for communicating with employees, shareholders, clients, suppliers and the board itself.

Now, more than ever, it’s critical for a company to communicate with all its stakeholders, adapting communications for each group in terms of frequency, content and tone. It’s become essential for boards to make sure this is done well. Boards can guide CEOs on best practices for communicating with employees, shareholders, clients, suppliers and the board itself.